- Sign In

- Create Account

Dream It, Plan It, Do It!

Not a Member? Join- Don't have an account? Sign Up

- Already a member? Sign In

Temet Nosce,

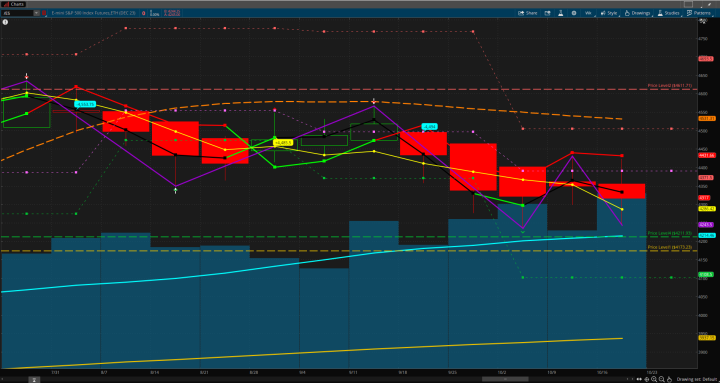

We saw the bear trend coming at the beginning of last week's daily and weekly charts. If you bought some PUTS you are in good shape. The market went down as expected and right now there are no signs of a reversal. I usually only jump into the beginning of a trend, make a few dollars and then wait for the next setup. However, based on the ES weekly chart the bear trend might continue into next week. Trends don't last forever, so I hope the Sunday October 22, 2023 candle provides some relief, but if not then I shall take what the market gives.

Just as in the previous week the ES, MES, SPX and XSP PUT options are in my sights and my targets of choice. There will be six trading days to show me whether to stay in or get out of the PUT options. What goes up, must come down, so I am looking for signs of a bull reversal at some point so I can buy the call options for the bull rally. However, as the candles move closer to crossing below the 200 day simple moving average, the situation still appears bearish.

Looking at the ES weekly chart you can see that the current direction is bearish, but this week's candle is indecisive. It showed that there was almost just as much buying as it was selling. However, other indicators point to a continued bear trend and show a little more selling to come. The first two daily candles of this week should show where the market is headed.

Considering where we are in the current bear trend, I plan to tread lightly if at all. I have already taken my profit from last week's entries and now I am fighting the urge to feel I need to make a trade just to be in the market. The market can only move three ways, up, down, and sideways, but during any of those moves there are investors losing money and making money. The objective is to have more wins than losses, so choose your battles wisely. Also consider any negative events in the news that could influence this week's direction. If you have an indicator that gives you insight into upcoming reversals I would keep an eye on it daily, or set an alert.

I hope my analysis helps you see something you did not see, or confirmed what you already saw. As always do your own research and manage your risk.

~MorpheusCCI~

RPB - CIC